ABOUT US

Our Methodology

Beyond Global Management combines investment expertise and a data-driven methodology to give you better insight into your investment performance.

Experienced Investment Leadership

Beyond’s leadership team is comprised of 5 highly knowledgeable investment professionals that collectively have over 100 years of successful financial experience across the four phases of market cycles.

Our leadership has experience in managing multi-asset class funds, private equity funds, and various real estate strategies. That experience, along with their industry reputation and the relationships built over the years, together with significant in-house resources and professional expertise, makes it possible for Beyond to offer unique investment opportunities.

Due to the cross-disciplinary nature of our skilled investment professionals, Beyond’s investment platform continuously analyzes valuable market data to identify potential future investment opportunities. We’ve invested significant resources into market-leading data services, which drives our capital allocation efforts.

Data-Driven Approach

We utilize the latest financial technology in the design of our investment structures with the goal of reducing volatility and hedging against downside risk during times of instability.

We are continuously adopting new technologies to help us in our goal to deliver higher yields, expand access to our private funds, and delivery purpose-built guidance for qualified investors. We strive to make the real estate market more transparent, make risks more controllable, and offer investments that provide income and growth opportunities.

Our Track Record

We are value investors with a perceptive, opportunistic approach to investing. Beyond seeks to capitalize on market dislocation and changing economic factors to identify the most attractive opportunities in any market condition.

Additionally, as both a debt and equity investor, Beyond has the flexibility to invest opportunistically in bull markets, and more prudently in bear markets. As we continue to grow, we remain committed to upholding high standards in determining projects that qualify within this defined focus.

We have established a track record of attractive, risk-adjusted real estate investment returns that beat inflation, generate income, and offer liquidity, which has earned us the trust of our clients. We are continuously adapting to deliver higher yields and expand access to alternative investments.

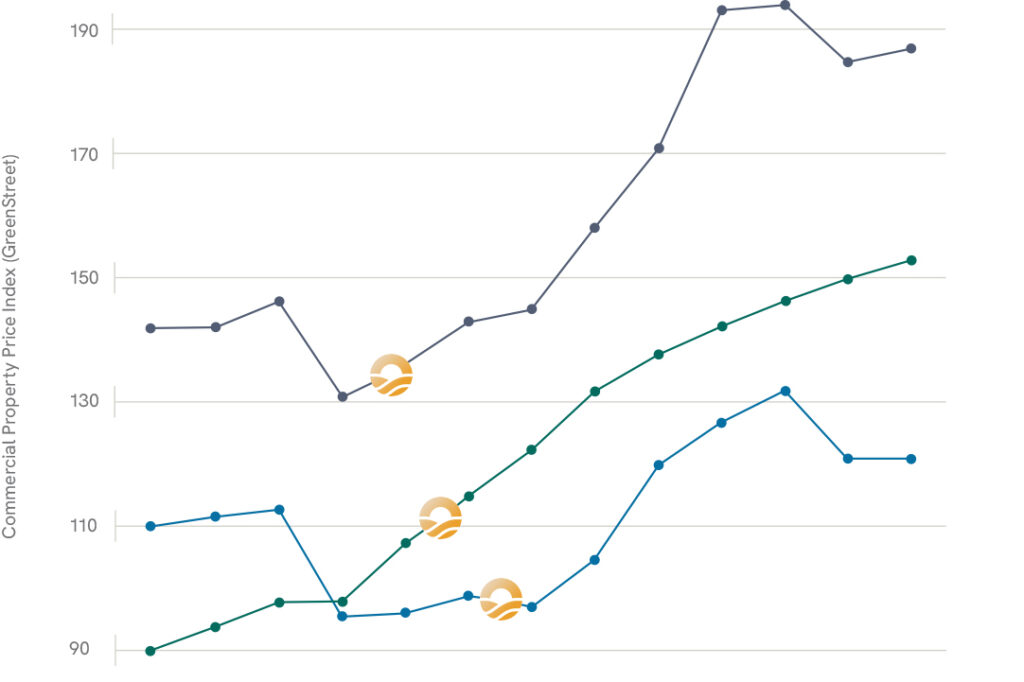

However, don’t just take it from us! While we are still a young and innovative firm, our entry points in certain investments speak for themselves. The chart below identifies the moments in time in which we’ve set up funds in specific markets or asset classes and the subsequent results of those investments.

Our entry points in certain investments speak for themselves

Beyond Global Management Equity Entry Points

| Quarter | Price |

|---|---|

| 3Q 2019 | 141.6 |

| 4Q 2019 | 141.8 |

| 1Q 2020 | 145.9 |

| 2Q 2020 | 130.5 |

| 3Q 2020 | 135.9 |

| 4Q 2020 | 142.7 |

| 1Q 2021 | 144.8 |

| 2Q 2021 | 158 |

| 3Q 2021 | 170.9 |

| 4Q 2021 | 193.1 |

| 1Q 2022 | 194 |

| 2Q 2022 | 184.7 |

| 3Q 2022 | 187 |

| Quarter | Price |

|---|---|

| 3Q 2019 | 110.9 |

| 4Q 2019 | 111.1 |

| 1Q 2020 | 112.2 |

| 2Q 2020 | 95.5 |

| 3Q 2020 | 95.6 |

| 4Q 2020 | 98.3 |

| 1Q 2021 | 96.5 |

| 2Q 2021 | 104.2 |

| 3Q 2021 | 119.5 |

| 4Q 2021 | 126.4 |

| 1Q 2022 | 131.5 |

| 2Q 2022 | 120.5 |

| 3Q 2022 | 120.4 |

| Quarter | Price |

|---|---|

| 3Q 2019 | 90.15 |

| 4Q 2019 | 93.25 |

| 1Q 2020 | 97.3 |

| 2Q 2020 | 97.35 |

| 3Q 2020 | 106.95 |

| 4Q 2020 | 114.4 |

| 1Q 2021 | 121.95 |

| 2Q 2021 | 131.45 |

| 3Q 2021 | 137.45 |

| 4Q 2021 | 142 |

| 1Q 2022 | 146.05 |

| 2Q 2022 | 149.6 |

| 3Q 2022 | 152.6 |

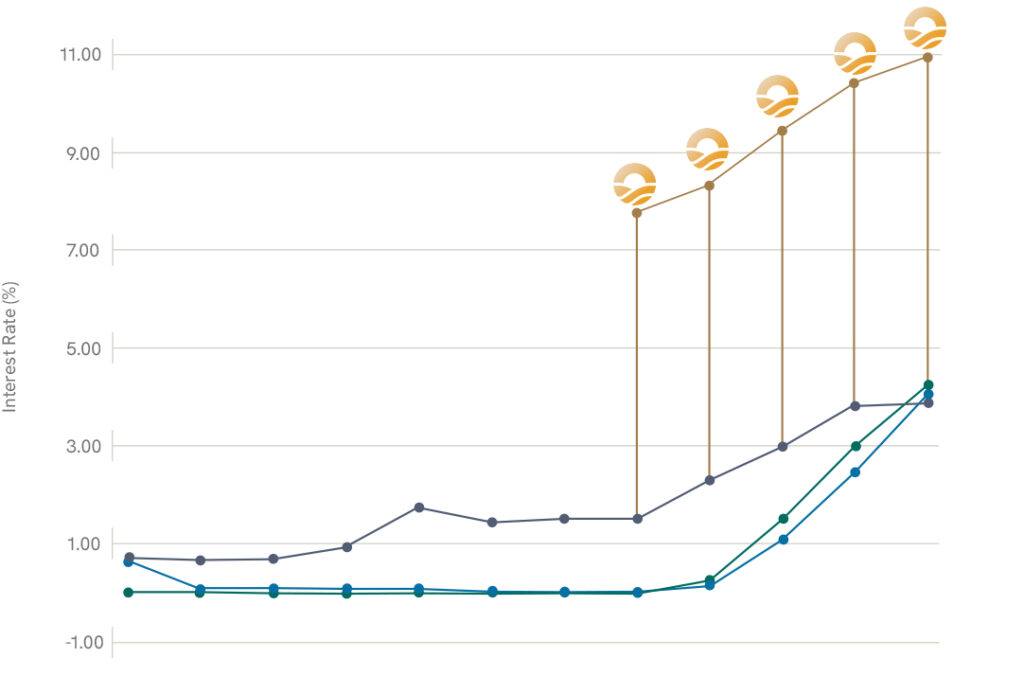

Credit-Heavy Investment Emphasis As Conditions Change

Beyond’s unique approach allows focus to shift to credit investing, imperative in a high interest rate environment, while still maintaining a necessary presence in the equity market.

In the below chart, you can see Beyond’s entry point as we focused more on a credit-heavy investment strategy. By accurately timing the initial set-up and administrative process of our credit funds, we were well positioned to invest in strong fixed-income investments when the macroeconomy began to demonstrate headwinds. Despite shifting risk profiles associated with a turbulent economic environment, our private market selection process allows for attractive opportunities to invest. As we anticipate a rising interest rate environment, our goal is to shorten investment terms for liquidity of investment. Once we identify the peak and plateau of interest rate hikes, we will consider locking in longer investment terms for high-yield offerings to our investor base.

Beyond Global Management Credit Entry Points

| Date | Interest Rate (%) |

|---|---|

| 3/31/2020 | 0.70 |

| 6/30/2020 | 0.66 |

| 9/30/2020 | 0.69 |

| 12/31/2020 | 0.93 |

| 3/31/2021 | 1.74 |

| 6/30/2021 | 1.45 |

| 9/30/2021 | 1.52 |

| 12/31/2021 | 1.52 |

| 3/31/2021 | 2.32 |

| 6/30/2022 | 2.98 |

| 9/30/2022 | 3.83 |

| 12/30/2022 | 3.88 |

| Date | Interest Rate (%) |

|---|---|

| 3/31/2020 | 0.65 |

| 6/30/2020 | 0.08 |

| 9/30/2020 | 0.09 |

| 12/31/2020 | 0.08 |

| 3/31/2021 | 0.01 |

| 6/30/2021 | 0.03 |

| 9/30/2021 | 0.05 |

| 12/31/2021 | 0.05 |

| 3/31/2021 | 0.16 |

| 6/30/2022 | 1.09 |

| 9/30/2022 | 2.47 |

| 12/30/2022 | 4.06 |

| Date | Interest Rate (%) |

|---|---|

| 3/31/2020 | 0.00 |

| 6/30/2020 | 0.00 |

| 9/30/2020 | 0.00 |

| 12/31/2020 | 0.00 |

| 3/31/2021 | 0.00 |

| 6/30/2021 | 0.00 |

| 9/30/2021 | 0.00 |

| 12/31/2021 | 0.00 |

| 3/31/2021 | 0.25 |

| 6/30/2022 | 1.50 |

| 9/30/2022 | 3.00 |

| 12/30/2022 | 4.25 |

| Date | Interest Rate (%) |

|---|---|

| 3/31/2020 | |

| 6/30/2020 | |

| 9/30/2020 | |

| 12/31/2020 | |

| 3/31/2021 | |

| 6/30/2021 | |

| 9/30/2021 | |

| 12/31/2021 | 7.87 |

| 3/31/2021 | 8.43 |

| 6/30/2022 | 9.60 |

| 9/30/2022 | 10.50 |

| 12/30/2022 | 11.00 |

Note: The above chart reflects Beyond entry point(s), not yield or returns offered by any specific Beyond products. It is a reflection of market timing, not any specific fund terms.

Our Team

Jenny Zhan, CFA

Chief Executive Officer

Jenny founded and leads all areas of business and operations for Beyond Global Management. She brings more than 20 years of investment experience focused on institutional investing and managing multi-asset strategies. As a Chartered Financial Analyst (CFA), she specializes in international wealth management and has managed investments in real estate assets and global equities markets for large institutional investors.

Previously, Ms. Zhan was a portfolio manager and managing director at GMO, a Boston-based global investment leader (AUM $68B), from 2002 to 2011, where she was recognized for the firm’s successful Greater China equity research and emerging market portfolio management. Prior to founding Beyond, she was the President of Good Hope Investment, a subsidiary of CreditEase Corporation. With her initiative and leadership, Good Hope quickly established its position as a top player in global investment immigration during her five-year tenure.

Ms. Zhan also served as Chief Strategy Officer of Ambow Education Holding Ltd. She is recognized as one of the most influential and powerful leaders in the investment migration industry globally. Ms. Zhan earned her B.E. from East China University of Science and Technology and her M.S. in Chemical Engineering from the University of Maryland.

Jason Ye

Managing Partner

Jason manages Beyond Global Management’s U.S. operations and brings more than 18 years of experience in cross-border investment and consulting. He has a deep understanding of the inner workings of multi-nationals and large corporations and is highly skilled in providing practical solutions to complex problems.

Throughout his career, Mr. Ye has developed a robust domestic business network and client portfolio, which became a solid foundation for Beyond in its early stages of growth. Prior to joining Beyond, he was a Director with Good Hope Investment from 2017 to 2019, where he led the business development effort and took part in capital raising and operations for the private fund business in the US market. He has played key roles in fund transactions, product design, and marketing.

From 2001 to 2016, Mr. Ye worked for PwC China and Singapore as a managing director where he advised more than 50 Fortune 500 multi-nationals, large corporations and leading businesses operating across different industries including technology, manufacturing, resources, and consumer goods and services. He also provided strategic and cross-border compliance counsel in key areas such as cross-border investment planning, profit repatriation, M&A, tax structuring, and value chain optimization. He holds ACCA and China Certified Public Accountant certifications.

Jimmy Lam

Managing Director of Investments

Jimmy leads the Beyond real estate investment team and brings more than 15 years of experience in sourcing, deal structuring, acquisitions, and debt investments.

In his previous position at Kirkwood Haven from 2018 to 2022, Mr. Lam was involved in acquisitions and asset management and was key to growing the firm’s real estate debt investment portfolio and developing the company’s market strategy. In addition to his role overseeing acquisitions and asset management, he was also responsible for the firm’s investor relations. During his tenure, he oversaw the firm’s hotel division operations and was pivotal in developing a highly successful investment strategy including sourcing, structuring, and financing multi-family and hospitality industry acquisitions.

During his tenure at Hines Global Income Trust from 2013 to 2018, he was involved in all aspects of real estate investments, financing, economic research, and asset management for the firm’s European Private Equity Fund. He also served on the investment team for Hines REIT and other public Hines vehicles, and led exploratory efforts to start new funds and find new markets for investments.

He holds a bachelor’s degree from the University of Houston.

Michael D.B. Duong

Investment Capital Manager

Michael serves as a liaison between Beyond’s investment team and all other departments to provide investment support and general business operations guidance. He is also a member of the firm’s investment committee.

Mr. Duong has more than 16 years of direct real estate investment experience. Prior to joining Beyond Global Management, he was a founding member and COO at 24/7 Capital, a boutique regional real estate private equity firm with a strong focus in retail, medical office, office, and industrial “small-cap” assets. In this role, he was responsible for all investment-related activities including acquisition, financial analysis, brokering, strategic execution, and disposition. Duong was a key team player and instrumental in building the firm’s recognition for identifying undervalued real estate assets and repositioning them to create maximum market value. Previously, he also worked within CBRE’s Valuation and Advisory department as a Valuation Associate.

Mr. Duong is a California-licensed real estate broker and holds a bachelor’s degree in business administration from University of California-Irvine.